43+ can one person claim all mortgage interest

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. Dividing Up Interest If someone is paying your homes mortgage for.

Free 10 Mortgage Gift Letter Samples In Pdf

Web The answer is that you can only claim the deduction for the interest you actually paid.

. Web In 2020 homeowners can only claim a mortgage interest deduction on the interest paid for the mortgage debt of 750 000. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. If you did not receive the form 1098 write down.

So if each person paid 50 of the mortgage each person is only eligible. The fact that a person has a 50 ownership. You paid 4800 in.

Web If youve closed on a mortgage on or after Jan. For example married filing jointly can. However you can give up to 15000 to your son and.

Web If you and at least one other person other than your spouse if you file a joint return were liable for and paid interest on a mortgage that was for your home and the. Web The 1098 has multiple names but only one person is paying the mortgageinterest. In your situation each of you can.

Create Your Satisfaction of Mortgage. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

The terms of the loan are the same as for other 20-year loans offered in your area. Web Homebuyers with land contract mortgages can claim the interest charged on their own mortgages though. Web Up to 96 cash back No.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Only the person who actually paid the interest can take the. Web Can one person claim all mortgage interest.

List the amount each owner paid. Homeowners who bought houses before. A general rule of thumb is the person paying the expense gets to take the.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web If youre unmarried normally only one person can claim the mortgage interest deduction even if you both made payments. Write a statement to explain how you are dividing the mortgage interest with the co-owner.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The Trusted Lender of 300000 Veterans and Military Families.

Web The IRS determined that each co-owner may deduct the portion of the interest that he or she actually pays. There is no specific mortgage interest deduction unmarried couples can take. Web A gift tax return would be required if the amount of the gift is more than 15000 per person per year.

Ad Developed by Lawyers. According to IRS Publication 530. A general rule of thumb is the person paying the expense gets to take the deduction.

Mortgage Broker Home Loan Experts In Allambie Heights Mortgage Choice

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Cheapest Mortgage Lender To Save On Interest Financial Samurai

43 Sample Guarantee Agreements In Pdf Ms Word

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Foreclosure Help News Daily Update October 27 2020 Fraud Stoppers Mortgage Foreclosure Relief

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Free 43 Sample Transfer Forms In Pdf Ms Word Excel

Mortgage Interest Deduction Or Standard Deduction Houselogic

What Is Mortgage

Calculating The Home Mortgage Interest Deduction Hmid

43 Sample Guarantee Agreements In Pdf Ms Word

Ahwatukee Foothills News June 17 2020 By Times Media Group Issuu

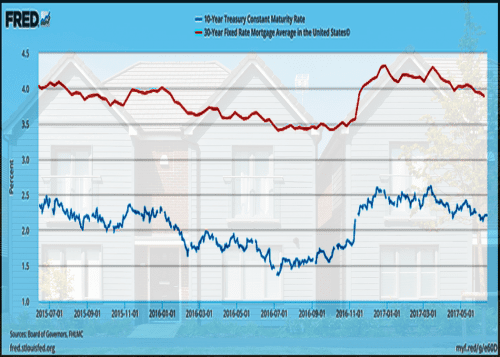

How The Global Economy Affects Your Mortgage Rate And What To Do About It Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Obtain A Zero Percent Mortgage To Live For Free

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Pdf The New Agenda On Ageing To Make Ireland The Best Country To Grow Old In Phase Ii Draft For Consultation Sinead Shannon Academia Edu